Smart Start Programs

Personal and Commercial Lines Information

Updated April 3, 2023

Overview: Personal & Commercial Lines

Smart Choice developed the Smart Start Programs to provide agents access to competitive, nationally branded carriers without an appointment. Both programs provide agents with a pathway to obtain a Smart Choice sub-code appointment. Both programs also utilize the Sales and Service Centers of Carriers (SSC) for customer service to clients.

Immediate Access to Appointed Smart Choice Agents

- Smart Choice Provides Training & Ongoing Support

- Pathway to obtaining a Smart Choice Direct Subcode Appointment

- SS Personal Lines after 25,000 of profitable DWP with a carrier

- SS Commercial Lines after 50,000 of profitable DWP with a carrier

- No Fees for either program–Seventy/Thirty (70/30) Commission Split

- SS Personal Lines requires Subscription to the Ezlynx Rater ($199 Setup & $118 Monthly)

- Carrier Sales & Service Centers provide customer service to clients. SSCL Carriers allow Agents to service clients directly; SSPL Carriers except for Allstate and Travelers allow Agents to service clients directly.

SMART START COMMERCIAL LINES (SSCL)

Writing commercial lines business should be a goal of every agency; Smart Start can assist you in meeting this goal.

Agencies face the daunting task of learning every carrier’s different coverage forms, terminology, different marketing techniques and obtaining competitive carrier appointments. But with Smart Start Commercial, agents simply complete a commercial quote request form, and we process and submit the form to our carriers’ in-house sales centers. We do the work for you! Lynn DePasquale manages this program–see her contact info below.

The Smart Start Commercial Lines program now includes a Specialty Brokerage department which is now available to provide access to several Standard Commercial Rish Markets : Trucking, Farm & Ranch, Dentistry, Non-Profits, Churches, and more. Joey Duggins manages this program–see her contact info below.

Transportation and Trucking Cover Whale and Fairmatic Transportation and Trucking are now available through Smart Start Commercial Specialty Brokerage in select states! SSCL has a team of Trucking Underwriters to get trucking risks up and running. We are excited to announce that as of April 1, 2023, Smart Choice has partnered with Fairmatic; a company that focuses on transportation and trucking, specifically Non-Emergency Medical Transport, Cannabis Delivery, Amazon Last Mile accounts and Artisan Contractor Fleets. All industry segments are 5 vehicle fleet and larger. Fairmatic has adjusted their appetite specifically for Smart Choice (they normally want 10 vehicles). The Fairmatic addition continues to expand our SSCL Trucking division. This business will be written as Brokerage through our Trucking Team out of the Home Office and will transact similar to a Middle Market account. Contact trucking@smartchoiceagents.com for more info. Learn More Request A Quote via SSCL Portal Send Trucking Risks To: Nate Murphy (888) 264-3388, ext 3086 nmcmurphy@smartchoiceagents.com

For Immediate Help with SSCL Contact:

Lynn DePasquale

For Questions about Risk Eligibility and Carrier Risk Markets

Vice President, Smart Start Commercial Lines

Phone: 336-217-4684

Lynnd@smartchoiceagents.com

For Immediate Help with Specialty Brokerage Contact:

Joey Duggins

For Specialty Commercial Brokerage Quote & Bind

Smart Start Commercial Associate

Toll Free 888-264-3388 ext. 3085

jduggins@smartchoiceagents.com

For Immediate Help with Transportation and Trucking Brokerage Contact:

Nate Murphy

For Specialty Commercial Brokerage Quote & Bind Transportation and Trucking

(888) 264-3388, ext 3086 nmcmurphy@smartchoiceagents.com

Contact trucking@smartchoiceagents.com for more info. Learn More Request A Quote via SSCL Portal

The Smart Start Commercial Lines Program allows agents instant access to 10 top-rated commercial lines carriers without needing an appointment and with no premium commitments. Has a 70/30 commission split with Smart Choice (Agent gets 70%) and are a pathway to a direct appointment. Features include:

- Instant Access to 8 Top-Rated Carriers

- No Appointment Needed with Carriers

- No premium volume requirements

- Write in 45 States without Licenses in Non Resident States

- Receive Competitive Commissions (most companies pay 15% on new business)

- Dedicated Underwriter to Assist Agents with Writing Risk

- Uses an Online Form on the Smart Choice Agents Business Center Portal

- Pathway to Smart Choice Sub-Code Direct Appointments

SMART START CL VIRGINIA CARRIERS:

- Nationwide

- Chubb

- CNA

- Dovetail – MetLife Small Business

- Guard

- Liberty Mutual

- Tapco

- The Hartford

- Travelers

SSCL WASHINGTON DC CARRIERS:

- Nationwide

- Tapco

- Travelers

Welcome to Smart Start Commercial (SSCL). We have partnered with national underwriting carriers to develop the opportunity to write commercial lines business quickly, efficiently and without appointments. Agents simply use our easy-to-navigate carrier preference guide to determine the proper underwriting market, fill out the Online Smart Start Referral Quote Form (It takes only a few minutes!), submit the form to our carriers’ in-house sales centers (a maximum of 3), and best of all–they do all the work for you. The national sales centers have a close ratio of 70% on qualified leads!

To submit your prospects please go to the Smart Choice® website www.smartchoiceagents.com and in the top right corner you will see a tab with Smart Choice login. Please enter your user name and password that you use to view your commission. (If you don’t know your password please contact Virginia TM Daniel Brown (DBrown@SmartChoiceAgents.com or call 804-896-3959). After you enter your user name and password you will see the Smart Start Tab on the menu tab, which will lead you to the CL and PL programs.

Highlights of the SSCL Commercial Insurance Program.

- Primarily A Small Business Preferred Risk Program. The SSCL program in Virginia currently has 10 carriers for agents to write primarily preferred Commercial Insurance business. Startups and Lapses in coverage will most likely need to be written with our Express Market E&S carriers. However, TAPCO Westchester Brokerage has recently been added to provide coverage for some Excess & Surplus (E&S) commercial risks.

- The SSCL Program is Available in Many States Outside of Virginia. Since Worldwide Insurance Network Agency is licensed in many states to write commercial business, the Smart Start agent may submit quotes and write business in states outside of Virginia. Smart Start Agents do not have to license their Agencies in other states to write out of state business in the SSCL program.

After Agent’s Smart Choice Agreement is Approved. After an agent’s Smart Choice Agreement has been approved, it usually take 30-60 days to obtain a sub-code appointment with a carrier–if the agent has 3 years or more of producer experience and has several hundred thousand of DWP to potentially move or write–otherwise the SSCL provides a pathway to obtain a Smart Choice sub-code appointment as will be explained. During this time, the SSCL program allows the agent to write business–immediately and not have to wait.

The program also provides a pathway to a Smart Choice sub-code appointment, after writing 50,000 profitable DWP. Thus, it is wise to write primarily with one carrier that works best for a market area.

NOTE: For convenience, in addition to our User Experience Information, we also have included the Smart Start Commercial documents provided by Smart Choice below at the end of this section.

Overview: User Experience Smart Start Commercial Lines

The following information provides an overview of how I and other Smart Choice agents have experienced and utilize the SSCL program. In March of 2012, I founded The Insurance Advisor agency after 14 years as a Nationwide Associate agent. The SSCL was a welcomed program that allowed me to immediately begin to write business and earn commissions with Nationally Branded, Top Rated Commercial Carriers.

How the SSCL Program Works

Writing business as a producer through the Smart Choice owned agency, Worldwide Insurance Network, the agent logs into their Smart Choice Agents Dashboard and clicks on the Smart Start NAV Tab and then clicks on the Quote link at the bottom left of the page. Training and Additional Resources links are available below the Quote Link. The agent then proceeds to complete a short quote referral form that will be sent to up to three selected carriers.

How to Use the SSCL Portal

- Watch the Smart Start Commercial Video: Smart Start Commercial Training Video

- Review the SSCL RESOURCES: AOR Forms, Appetite Guides, and More.

- Sign into the SSCL Portal. Sign into the SSCL Portal at www.smartchoiceagents.com. Please enter your user name and password that you use to view your commission.(If you don’t know your password please contact Virginia TM Daniel Brown (DBrown@SmartChoiceAgents.com or call 804-896-3959). NOTE: For Agencies that have multiple commercial producers and would like each to have a separate login for each, please also contact Daniel Brown via the above email or phone number.

After you enter your user name and password, you will see the Smart Start NAV Tab on the top navigation menu tab. Click on Smart Start Tab; the SSCL Links are located on the left bottom of the page. Click on Quote to go to the SSCL Quote Request Portal.

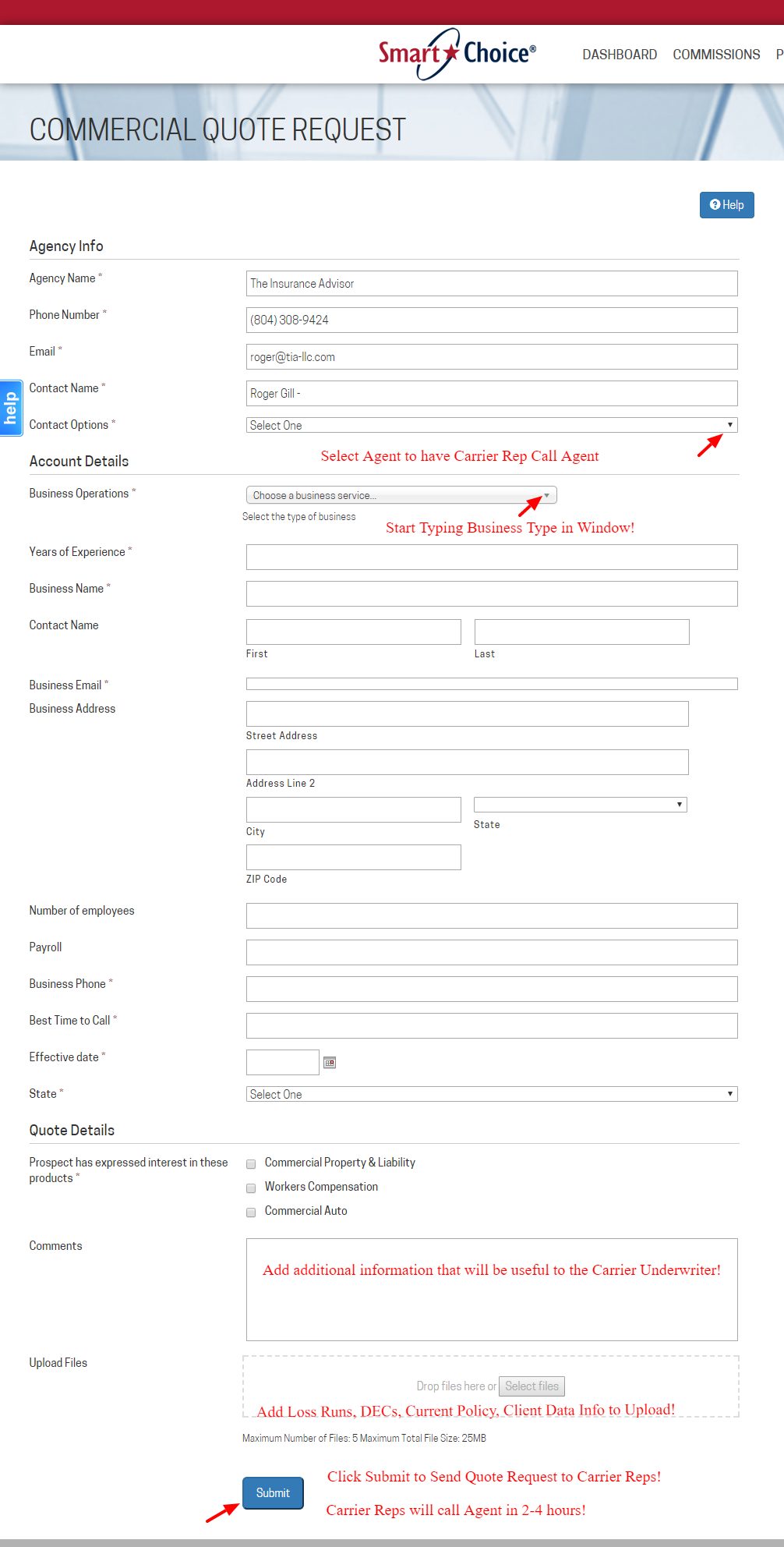

The SSCL Portal Quote Form:

After a review of the training, Click on the “Start A Commercial Quote” link to start a new commercial quote request by completing and submitting the SSCL Quote Referral Form.

- SSCL Form Section 1: Agency Info. This section is prefilled with the agent’s profile information. Make sure that it is correct. Contact information can be for the agent or the prospect.

- NOTE: Hartford will only speak with the prospect.

- VERY IMPORTANT: If you would like for the Carrier Producers to contact you–the agent–provide your name as the contact person and select Contact Agent in the drop down window.

- SSCL Form Section 2: Account Details. In the Business Operations window, start typing the type of business or service (Restaurant, Florists, Dry Cleaners, etc…). All you need is the first couple of letters of the business type and the search engine will provide the business classes with the SIC codes. If you have difficulty with the correct type of business, please refer to the carrier guides below (also available at SSCL RESOURCES: or to the following SIC Code site http://www.osha.gov/pls/imis/sicsearch.html to determine the proper description.

-

- Complete the Account Details Section. This minimum information is needed to provide a quote. NOTE: The Business Phone Number in this Section must be the phone number of the business. Most Carriers track the quotes with the business phone number–the quote may be locked, if already quoted by another agency.

- The SSCL Program is Available in Many States Outside of Virginia. Since Worldwide Insurance Network Agency is licensed in many states to write commercial business, the Smart Start agent may submit quotes and write business in states outside of Virginia. Smart Start Agents do not have to license their Agencies in other states to write out-of -state business in the SSCL program.

- SSCL Form Section 3: Quote Details. Select the coverages that you would like the carrier to quote.

- Comment Box. In the comment box, please enter any special instructions or comments that will help the raters and underwriters to better understand the account. This is also where you will designate carriers if the drop-down does not appear.

- File Upload: Upload Needed Quote Information. Before submitting the Quote Request Form, the agent should upload the necessary information that the Carrier Sales & Service Producer(s) will need to provide a quote with necessary coverages and with an accurate price. I usually provide an Application (Accord Forms), Loss Runs (5 Years if Possible), DEC Pages of Current Policies, Current Policies, and a Commercial Client Data Intake Form which agents may download and customize. Note: This is a form that I developed for The Insurance Advisor. Please feel free to download and customize.

After You Submit The Quote. You will be notified of the status of your quote as it progresses by email. When the policy is bound, you will get an email with the policy attached that includes instructions on delivery and service. See the example at the bottom of this page.

COMMERCIAL QUOTE FORM

Thank you for allowing our agency the opportunity to provide you with business insurance quote(s). Before we get started, we need to know about you and your business. The information you provide is essential for us to conduct a thorough risk analysis.

Once we’ve identified the business exposures, we will then select the appropriate Commercial and Liability Insurance carriers. Our Licensed Agents will shop your business insurance with these carriers to identify the best fit for your insurance needs, at an affordable price.

Please complete this intake form in its entirety. If an answer does not apply, please notate using “n/a.”

Applying for Commercial Insurance can be a lengthy process. The underwriters will scrutinize the applications and supporting documents prior to quoting. There is no guaranteed timeline in which The Insurance Advisor will discover and bind insurance coverages. It is suggested to expect a minimum 30 day turnaround time for quotes.

| Date Insurance Required | |

| Primary Contact | |

| Name of Insured (Entity) | |

| Legal Company Name | |

| DBA | |

| Type of Entity | Circle all that apply:

Sole Proprietor Incorporated Nonprofit Partnership Limited Liability Company Trust |

| Year Business Began | |

| Years of Experience in Same Industry | |

| Name of All Owners /

% Ownership |

|

| FID/FEIN Number | |

| Address, City, State, Zip | |

| Business Phone | |

| Mobile Phone | |

| Fax | |

| Website |

| Description of Business Operations, Products/Services

Please describe your business with the following information if applicable. Industry (retail, mfg, restaurant, etc), services and products that your company sells/provides, and recent changes such as, company mergers, buyouts, traded stock, ownership, corporation status, etc. |

|||

| Type of Insurance Required (If known)

Amount of Liability Required (If known) $1 mil/$2 mil $2 mil/$4 mil |

Business Property | Errors & Omissions | |

| General Liability | Liquor Liability | ||

| Professional Liability | Employee Practice Liability | ||

| Directors & Officers | Workers Comp | ||

| Cyber Liability | Employee Benefits Coverage | ||

| Bonds | Commercial Auto | ||

| Building Coverage | Umbrella | ||

| Additional Insureds

Lien holder, Mortgage Company, Leasing Company/Landlord, etc. Please include company name, complete mailing address, contact person/department and account/loan numbers. |

| Number of Employees | |

| Full Time | |

| Part Time | |

| Hourly | |

| Salary | |

| Administrative | |

| Driver/Operators | |

| Annual Payroll | |

| Annual Gross Revenue | |

| Amount Subcontracted | |

| Value of Business Property (BPP)

The value of your BPP shall be calculated on the replacement cost, versus actual cash value. Consider tools, machines, computers, inventory, furniture, business supplies, etc. |

| Building Details

Tax Assessment records will be pulled for building structure details. Please provide any additional information that may be helpful when determining the replacement cost.

|

| Number of Company Vehicles and Types

Cars, heavy duty trucks, box trucks, 18 wheeler, vans, trailers, etc. |

| Licensed Drivers:

Name, Birth Date, Drivers License Number |

| 1) |

| 2) |

| 3) |

| 4) |

| 5) |

| 6) |

SUPPORTING DOCUMENTS

Insurance carriers will require supporting documentation for each insurance application. Please submit the Required Insurance Supporting Documents along with a complete intake data form. Other documents that may be requested are listed below.

Required Documentation for the Initial Assessment

- Lienholder’s insurance requirements. *Lienholders include banks, mortgage companies, or any lending institution that has specific insurance requirements of the borrower.

- Landlord insurance requirements, if applicable.

- Loss Run Reports (5 years) from current insurance company. These reports provide a history of insurance activity for the business; including claims and/or losses.

- Current business owner’s insurance declaration pages, if applicable.

Other Information and/or Documentation That May Be Requested

- Commercial Auto Details

-

-

- List of owned vehicles.

- List of all drivers and the following information for each driver. Full name, home address, birthday, social security number, driver license number, and CDL Date.

- List of vehicles and their VIN numbers. Copy(s) of the registration card(s), if accessible.

-

- Payroll Records (6 months-1 year if possible)

- Value of employee benefits package (401k, health insurance)

- Lease Agreement (If renter)

- Building Assessment/Appraisal (If owned)

- Business Plan/Resume

- Articles of Incorporation/Bylaws

- List of Directors/Investors

- Customer Contracts/ Hold Harmless Agreements

- Outside vendor contracts and maintenance agreements.

- Assessments or Studies

- Inventory and replacement value of business property; ie: Office equipment – Electronics – Computers – Machines

- Copy of Company Safety Procedures, if applicable.

- ISO 9000 and/or OSHA documentation, if applicable.

- List of Safety Equipment (eye wash station, fire extinguishers, etc.)

After You Submit The Quote. You will be notified of the status of your quote as it progresses by email. When the policy is bound, you will get an email with the policy attached that includes instructions on delivery and service. See the example below:

Hi,

I have attached your policy copy. Your insured will get a copy mailed directly to him from Liberty Mutual.

If you have any Service Requests you can email Liberty Mutual at businessservice@libertymutual.com or call 1-800-962-7132. You will need to reference this RAMP CODE 2711247 when you are sending an email or calling as this will identify you as a Smart Choice agent.

**AGENTS! YOU NOW HAVE THE ABILITY TO SPEAK WITH LIBERTY MUTUAL ABOUT BILLING ISSUES! TO DO SO, YOU WILL NEED TO IDENTIFY YOURSELF WITH THE RAMP CODE 2711247**

When calling, use the Liberty Mutual BILLING PHONE NUMBER: 866-290-2920, and indicate that you are a sub-agent with Smart Choice with a billing question on behalf of our mutual insured, “ABC Company”.

These policies will auto renew each year, and I will send you a copy at that time.

Thanks so much for writing this with Smart Start Commercial and Liberty Mutual.

Misty Field

Smart Start Commercial

Phone: 888-264-3388 x3404

Fax: 270-685-1581

www.smartchoiceagents.com